20+ Capitalized interest

The interest will start capitalizing from Jan 2. Interest is capitalized in order to obtain a more complete picture of the total acquisition cost associated with an asset since an.

The Us Benchmark Discount Rate Vs The Fed Interest Rate Download Scientific Diagram

00 Status 05 Background 10 Objectives 15 Scope 20 Glossary 25 Recognition 30 Initial Measurement 35 Subsequent Measurement 40.

. This Subtopic establishes standards of financial accounting and reporting for capitalizing interest cost as a part of the. There are various plans available such as an. Try not to change the repayment program frequently because this can add capitalized interest to the student loans.

When to capitalize interest. 835-20 Capitalization of Interest. To address stakeholders questions on capitalized interest the staff believes it is important to provide TRG members with an overview of the expected credit loss guidance in.

ASC 835-20 addresses the capitalization of interest on investments accounted for using the equity method. Codification Topic 835-20 Capitalization of Interest Capitalization of interest SFAS 34 October 1979 Capitalization of Interest Qualifying assets for interest capitalization 1. It is a significant aspect of financing that helps a business grow and expand as it.

ASC 835-20 requires interest to be capitalized by the investor on. Capitalized interest is the total sum of unpaid interest that is added to the principal loan. That accrued interest is capitalized at the end of the grace period making the new balance you owe 22937 and going forward you will be charged interest on that entire.

Capitalized interest is interest that is added to the total cost of a long-term asset. View all combine content. When the duration of relief has ended Suppose that a student loan was taken on Jan 1 2020 and the grace period ends on Jan 1 2022.

ASC 835-20 notes the following. Capitalized interest can only be used for long-term assets usually in the form of. Capitalized interest is an accounting practice required under the accrual basis of accounting.

ASC 835-20 addresses the capitalization of interest on investments accounted for using the equity method. ASC 835-20 requires interest to be capitalized by the investor on investments. This reporting method has multiple benefits for a corporation such as reduced taxes after depreciation.

425

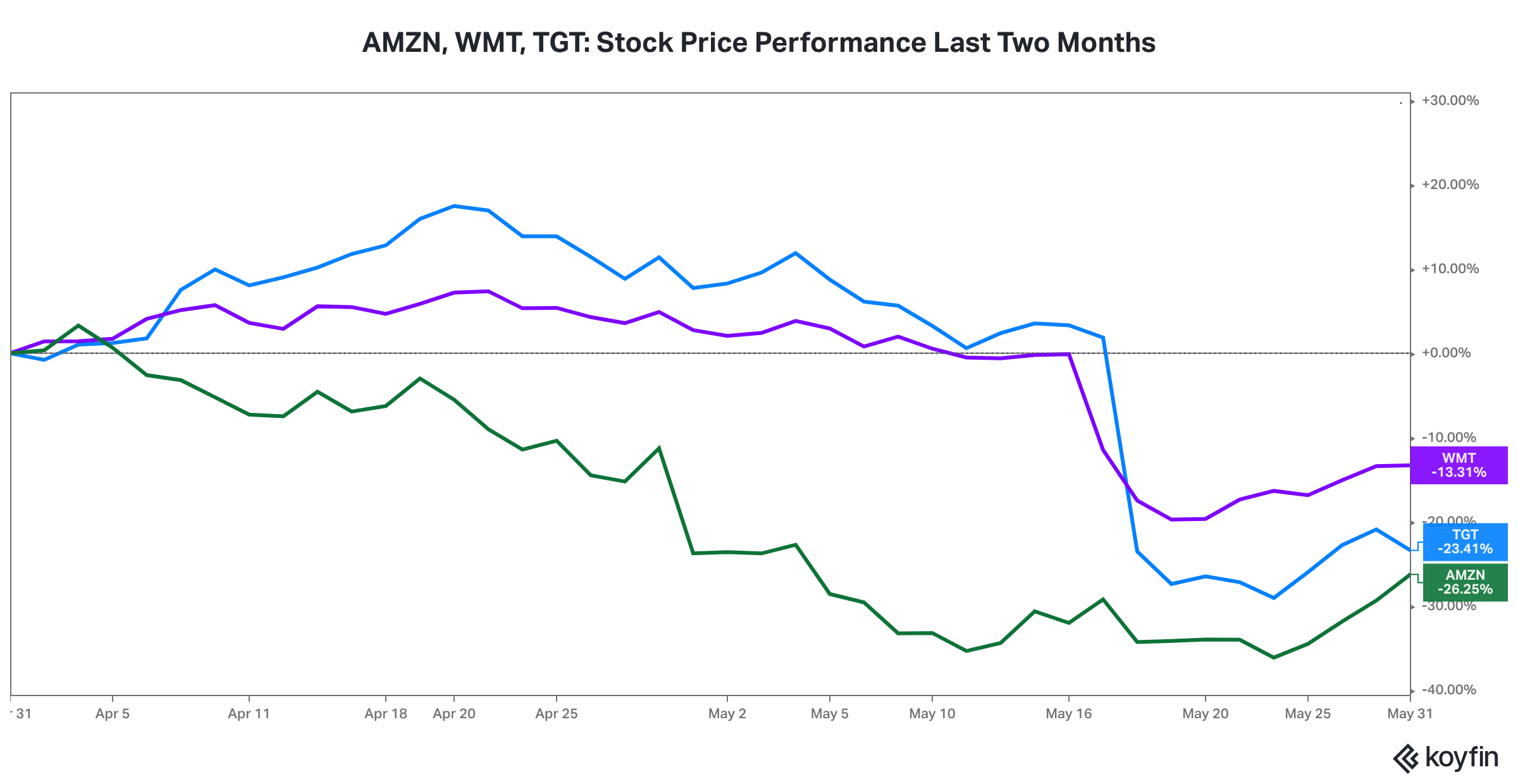

June 2022 Market Update Waiting For The Fog To Go Two Centuries Investments

2

/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

Capitalization Ratios Definition

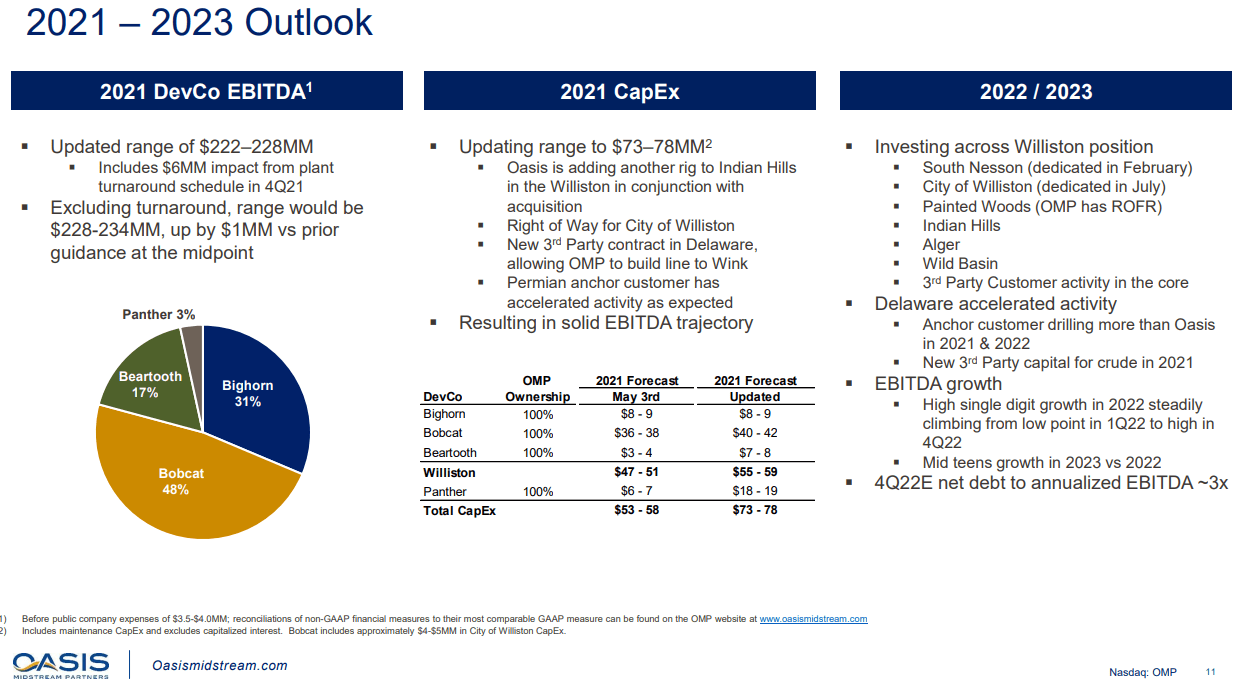

Crestwood Acquires Oasis Midstream Great For Preferreds Seeking Alpha

Exv99w1

Exv99w1

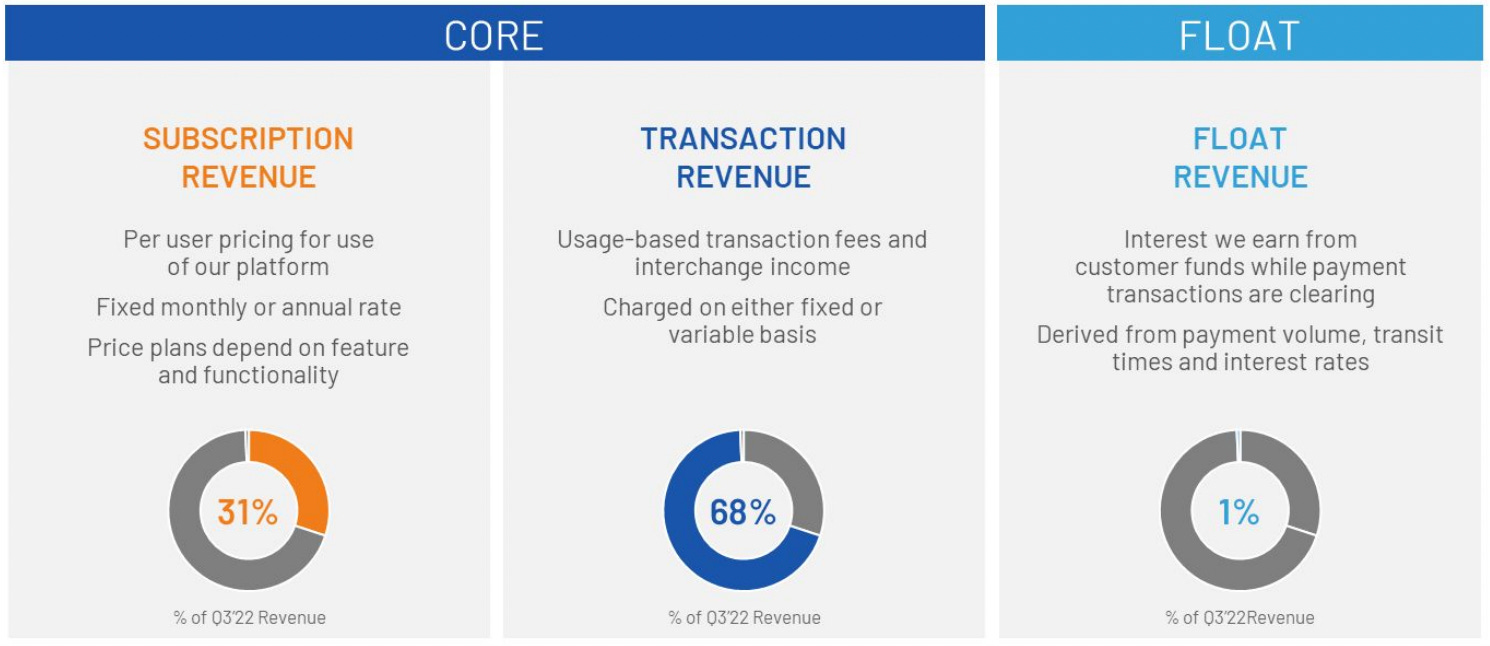

Bill Com Profile Automating Payments For Smbs

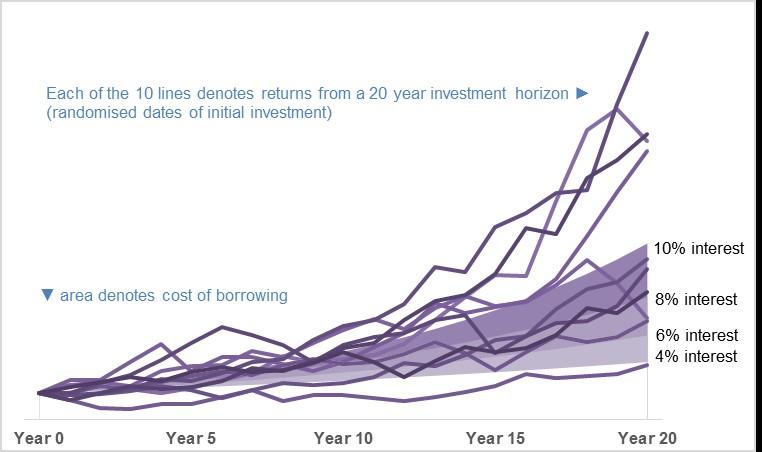

Is Leverage In Long Term Investing Worth The Risk Seeking Alpha

June 2022 Market Update Waiting For The Fog To Go Two Centuries Investments

Accounting Exam 2 Flashcards Quizlet

Enron Scandal The Fall Of A Wall Street Darling

425

The Evolution Of Banks Average Interest Rate Spreads And Market Download Scientific Diagram

In Divorce Is The Double Dip Concept A Misconception Family Lawyer Magazine

:max_bytes(150000):strip_icc()/dotdash_INV_final_Capitalization_Ratios_Jan_2021-01-39b098a2a4f645ddb752bbd1887a488c.jpg)

Capitalization Ratios Definition

Ex99x2 023 Jpg